Bubble : Anat Biletzki

Bubble : Anat Biletzki Introduction Is “bubble” a concept, except in the trivial sense in which every word ensconced in quotes becomes a concept, or rather a “concept”? More pertinently, is it a political concept? Is the philosophical exercise of making it a political concept a legitimate exercise, or, does such an exercise run the professional risk of philosophical facetiousness? And, bounding over the philosophical hazards, are we not enjoined to also explicitly and essentially explicate the political in “political concept”? Of the many concepts entertained in a project of lexicon-building, “bubble” appears especially suspect of being an interloper. We aspire to lay this suspicion to rest; “bubble” will satisfy the criteria of being a political concept precisely, even if indirectly, by our recognition of political bubbles. Let us begin, then, with differential diagnosis, pinpointing those bubbles of ostensibly ordinary discourse which will not serve this exercise. Think of famous bubbles, and invariably what comes to mind are Macbeth’s witches intoning—

It is, also, in another Macbethian locus that we ascertain another, somewhat different, yet still common bubble association:

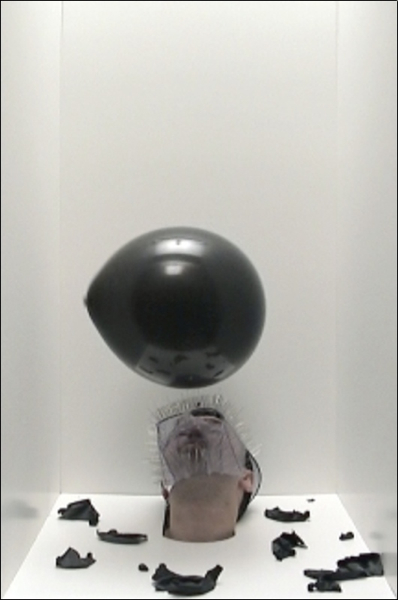

These infamous bubbles have the grammatical form of either a plural noun or a verb: ‘bubbles’, rather than a single bubble, are their natural mode of reference. Activity, rather than passivity, is their wont. Accordingly, the word’s literal meaning (assuming that we are on safe ground referring to literal meanings) connects plural noun and verb, as does Macbeth—bespeaking movement, noise, effervescence, tension, temporariness, ephemerality, transience, and a wavering between positive and negative dispositions that arise from precisely our indecision enveloped by all the above. More so, the bubbles that are thus perceived, as actively bubbling, have a tendency to either appear as empty to begin with or to vanish into consequent emptiness, sometimes even bursting or exploding into nothing. It is this impermanence that makes bubbles so conducive to a certain metaphorical use on the heels of the literal, material meaning of “bubble.” I submit that is the conventional meaning of “economic bubbles” now so much with us. When performing upon the economic stage, these bubbles have a veritable and far longer history: from the Dutch tulip bubble in the seventeenth century, through the South Sea bubble in the eighteenth century, the Australian land bubble in the 1880s, the Poseidon nickel bubble of 1969-1970, the dot com bubble of the turn of the twenty-first century, to, of course, the most recent housing bubble. Professional labeling and theoretical explanations conspire to yield a multiplicity of categories of bubbles that enrich the discussion in economics: stock and property bubbles, speculative bubbles in general, market bubbles, price bubbles, financial bubbles, and so on.1 So ubiquitous is the economic use of “bubble” that the original literal use and derived metaphorical use have merged, creating a key economic term to be used in new literal environs. One can easily adduce suggested definitions of bubbles in the context of economics that have left the metaphor behind, such as the very succinct “a bubble is an upward price movement over an extended range that then implodes”—or the more rigorous sounding: “a bubble is an asset market event where prices rise, potentially with justification, rise further on the back of speculation, and then fall dramatically for no clear reason when the speculation collapses.”2 Clearly, the familiar predicates of literal bubbles as enumerated above are facilely utilized for the economic metaphor and the metaphor, morphing back into literality, does fitting explanatory service. Still, although it seems intuitively robust, this is the wrong metaphor for our present endeavor; that is to say, ours is a different bubble. In the realm of politics, we are afforded a very dissimilar metaphorical bubble. Macbeth’s bubbles, like those of economics, with their attendant associations of transitory, mobile, plural and wispy entities, are not the political bubble entertained here. Instead, I turn to two other unique facets of bubblehood3—touching upon a singular, insular bubble rather than plural bubbles and emphasizing, instead of fleeting movement into nothing, the self-enclosing of a bubble: its insularity, its closing off from the outside world, and, nevertheless, its transparent membrane, which preserves a visual, but no more than visual, link between its inside and the outside. These will be the traits of bubbles that make them not only susceptible to political (conceptual) use but undeniably and essentially political bubbles. A Detour A methodological detour: Philosophy is the language game devoted to providing a rational, critical analysis of concepts. If “bubble” is a philosophical concept, then its philosophical treatment demands a rational, critical analysis. Notice the conditional; it suggests that a bubble’s conceptual ontology is what gives rise to the kind of (rational, critical) employment attempted here. If “bubble” is not an existing concept in the context of philosophical interest adumbrated here, then the exercise is moot. So, admittedly there is a presupposition of concepthood that underlies our analysis. Furthermore, beyond this presupposition, we are working under a motivational objective: not only is “bubble” a concept, but it is a political concept; and that postulate makes this philosophical project cohere with its political agenda. Put differently, it is precisely the political that bids us make our rational, critical stance politically significant. In other words, the question ‘what makes “bubble” a political concept’ is now translated into ‘what is a “political bubble”’?

Wittgenstein, somewhat maligned (and, I dare say, misunderstood) and often unfairly flattened out unto merely linguistic terms in investigations of “concepts,” provides our tangible, operational tool in this examination of bubble.5 Pursuing answers to the questions above that drive this investigation, there will be no pretension here of a theoretical endeavor at determining the essence of political bubbles. My method will be one adhering to Wittgenstein’s admonition to describe by description and example rather than explanation (though I will eschew his further conclusion: “don’t think, look!” in the search for understanding).6 An amassment of instances will expose us to political bubbles and will thus bring us to a better understanding of “bubble,” and this will be an understanding that derives from something other than unadulterated theoretical explanation. This is not to say that we will be reneging on rational, critical analysis; on the contrary, it will be a Wittgensteinian meandering among the exemplars of political bubbles that will provide the rational, and more so, the critical analysis needed for both philosophical and political understanding. 1. James Montier, “Running with the Devil: The Advent of A Cynical Bubble” in Social Science Research Network. http://dx.doi.org/10.2139/ssrn.489262, accessed April 2012.↩ 2. Charles P. Kindleberger, Manias, Panics and Crashes: A History of Financial Crises (New York: John Wiley & Sons, 2000) cited in John Simon, “Three Australian Asset-Price Bubbles,” in Asset Prices and Monetary Policy: Proceedings of a Conference Held at the H.C. Coombs Centre for Financial Studies, Kirribilli on August 18-19, 2003, ed. Anthony Richards and Tim Robinson (Sydney: Economic Group, Reserve Bank of Australia, 2003), 17. http://www.rba.gov.au/publications/confs/2003/simon.pdf, accessed April 2012; Simon, “Three Australian Asset-Price Bubbles,” 17-8.↩ 3. These are distinct from plurality and activity. Whether they be contrary to these characteristics, complementary, or simply indifferent is worthy of another investigation. Still other questions, arising in the philosophy of language, might address the question of why there are two such different types of bubbles in ordinary parlance.↩ 4. Ludwig Wittgenstein, Philosophical Investigations, trans. G.E.M. Anscombe (Oxford: Blackwell, 1953), §116.↩ 5. See for example Adi Ophir, “Concept,” in Political Concepts: A Critical Lexicon. http://www.politicalconcepts.org, accessed April 2012. For a strikingly different assessment of Wittgenstein on concepts see Gordon Baker, “Wittgenstein: Concepts or Conceptions?” The Harvard Review of Philosophy IX (2001), 7-23.↩ 6. Ludwig Wittgenstein, Philosophical Investigations, §66.↩ |